How Anyone Can Retire in 7 Years or Less

🎙️ Listen to the Conversation

In-depth discussion about this topic

Introduction

What if you could step away from the daily grind and achieve financial freedom in just seven years? No lottery tickets, no lucky breaks—just a proven plan built on smart decisions and intentional action. In just seven years, you could lay the groundwork to have all your daily living expenses paid for without the need to work, think of starting life with your own pension, or trust fund, powered by a portfolio of tangible, wealth-generating assets. This isn’t just a dream—it’s a strategy that allows you to design your life on your own terms, free from the pressures of living paycheck to paycheck, stuck in careers you don’t enjoy.

Contrast that with the traditional path: spending decades working, often starting out saddled with tens or even hundreds of thousands of dollars in student debt, enduring constant financial stress, and simply hoping to retire someday in your 60’s.

But what if you could rewrite that story? What if you prioritized building wealth first, achieving financial independence early, and then used that as a launchpad to create the life you’ve always dreamed of? Imagine setting yourself up financially before pursuing education or a career, giving yourself the ultimate advantage. This isn’t about chasing money for its own sake—it’s about creating freedom, reducing stress, and unlocking the ability to follow your passions without the weight of financial worry.

This guide outlines the steps to achieve this ambitious goal—not through shortcuts or chance, but through disciplined, intentional strategies that work. If you’re ready to break free from the conventional grind and create a new reality, this is your blueprint.

Let’s explore how you can fast-track your journey to financial independence, maximize your potential, and build a future where your time is your own. Seven years from now, your life could look very different—and it all starts here.

If you wish to skip ahead and dive straight into my modeled scenario of turning a $100,000 salary into over $2 million in assets within just seven years, click the link below. Discover how proven strategies can help you build substantial equity in multiple properties, grow a robust investment portfolio, and achieve a net worth of over $840,000. Jump into the model scenario here.

This guide is not your average financial advice. It’s an extreme blueprint based on real-world lessons and principles that I’ve learned and lived. It’s designed for those who are ready to challenge conventional wisdom, live differently for a few years, and reap the rewards of a life untethered from financial worries.

Here’s what you can expect in this guide:

- Part 1: Adopt a Sacrifice Mindset Embrace short-term sacrifices, take the long term view for building a foundation of wealth.

- Part 2: Build the Financial Base Identify and eliminate unnecessary expenditures to increase your savings rate to 75% of your income. Focuing on Housing, Transportation, Food and Consumerism.

- Part 3: Career Strategies for Rapid Growth Maximize your earning potential with hacks to increase your income and unlock new job opportunities.

- Part 4: Advanced Strategies for Financial Independence Learn key investment opportunities such as real estate, businesses, and index funds, as well as job opportunities that offer equity or ownership. These avenues can pave the way for exponential financial growth and long-term wealth building.

- Part 5: Overcome Roadblocks Address common challenges by maintaining discipline, continuously educating yourself, and staying committed to your financial goals.

- Part 6: The Snowball Effect How to leverage your assets, realationships and skills to create a snowball effect of exponential and perpetual growth.

- Example Scenario How to turn a $100,000 salary and turn it into over $2 million in assets within just seven years.

Retiring in 7 years requires determination and sacrifice. It means saying no to short-term comforts for long-term rewards. But if you’re ready to embrace the challenge, this guide will provide the road map to get there.

There are countless paths you can take to achieve your financial goals, even if entrepreneurship, real estate, or stocks aren’t your areas of interest. What I’m sharing here is a broad overview of what I’ve done, what I would do in similar situations, and what I recommend based on my experience.

The strategies outlined below are designed for those starting from scratch—whether you’re at $0, in debt, without skills, or unemployed. If you don’t have the advantage of a high-income career, focusing on maximizing expense reduction becomes crucial. This is a practical plan you can begin today, no need to go back to school.

This isn’t just about money; it’s about freedom. The freedom to live on your terms, pursue your passions, and never again feel like you’re stuck in the endless cycle of trading time for money. So, are you ready to take control and create the life you’ve always wanted? Let’s get started!

Part 1: The Foundation - Mindset and Sacrifice

Achieving financial freedom in just 7 years starts with laying the right foundation. This means developing a mindset of sacrifice, shifting how you think about money and work, and embracing a disciplined approach to living. The journey won’t be easy, but the rewards will last a lifetime.

The Sacrifice Mindset

Success demands sacrifice. If you’re not willing to give, don’t expect to get. This idea isn’t just a cliché—it’s a principle that separates those who dream from those who achieve.

To achieve success, it often means constantly challenging yourself, taking on multiple jobs or side hustles to maximize income in the short term. It’s challenging and grueling, but it’s temporary—and the payoff is well worth the effort.

Think of these first few years as an investment in your future self. Every dollar saved and invested today brings you closer to a life where work is optional. Sacrifice now to enjoy freedom later.

Why Sacrifice is Worth It

Sacrifice is the price you pay for freedom. The temporary discomfort of working hard, saving aggressively, and cutting expenses will lead to a lifetime of options. Once you’ve reached financial independence, you’ll have the flexibility to:

- Spend more time with loved ones.

- Start the business you’ve always wanted.

- Switch careers without the worry of income.

- Pursue passions without worrying about income.

- Explore interests or careers that genuinely fulfill you.

- Never again do something you don’t want to, live life on your own terms.

- Start your post-secondary education with the flexability of being financially secure.

- Enjoy complete individual freedom, the ability to travel when you want, say what you want, wear what you want, etc.

The first step to retiring in 7 years or less is building the foundation with a mindset of sacrifice and growth. The strategies may feel extreme at first, but they will quickly become second nature as you see progress. The key is to remember why you’re doing this: to create a life of freedom and abundance.

1440 Minutes ⏳

Every single day, you’re gifted with 1440 minutes. That’s 1440 opportunities to move closer to your disred life. But let’s face it: how many of those minutes slip away as you mindlessly scroll through social media, binge-watch shows, or idle in front of a screen during your free time?

What if you became intentional with your time? Here’s a simple yet transformative challenge: track your day. Use a free tool like Google Sheets to log how you spend each half-hour. When you review it, the results might astonish you. You’ll uncover habits and distractions silently steering you away from your goals.

If you’ve ever thought, “I don’t have time”—whether it’s for exercising, starting a side hustle, or pursuing a passion—ask yourself: Where is your time actually going?

- 45+ minutes in traffic daily?

- Move closer to work

- Switch to remote work

- Make the most of commute with podcasts/audiobooks

- Hours lost on social media?

- Set app limits

- Consider a digital detox

- Endless streaming sessions?

- Cut screen time in half

- Reclaim those hours for productivity

- Early to bed, early to rise

- Productivity often dwindles after 9 PM, turning into mere time-wasting.

- Starting your day earlier gives you a head start, helping you accomplish more. Tackling the hardest tasks first makes the rest of the day feel smoother and more manageable.

The key isn’t to find excuses for why you can’t; it’s to find solutions as if everything depends on it. Take ownership of your time—it’s your most valuable resource, and wasting it comes at the ultimate cost.

Where Does Your Time Go? A Glimpse into the Average Day

To truly understand how much time you have, let’s break down a typical day:

Daily Essentials:

- Work: 8-9 hours (540 minutes)

- Sleep: 7-8 hours (450 minutes)

- Commute: .5 hours (30 minutes)

- Food Prep & Eating: .5 hours (30 minutes)

This adds up to about 18 hours (1,080 minutes), leaving you with roughly 5 hours (300 minutes) for everything else. But here’s the kicker: most people fill that remaining time with:

Common Time Drains:

- Social media: An average of 2.5 hours

- TV or streaming: An average of 3 hours

- Miscellaneous distractions: Countless more minutes lost

By the end of the day, there’s often barely any time left for personal growth, pursuing dreams, or even getting quality rest. Now, imagine if those extra 3–6 daily hours were used productively. That’s essentially another 40-hour workweek to be utilized for a second job, starting business, learning new skills, etc. all while still leaving time available for weekends for socializing, hobbies, and relaxation.

The Mindset Shift 🧠

You’re not going to get rich renting out your time. You must own equity — a piece of a business — to gain your financial freedom - Naval Ravikant

One of the biggest mental hurdles on the path to financial independence is moving away from the idea of working for money. Instead, you need to think about acquiring assets—things that generate income for you without requiring your constant effort.

Here’s why:

- Jobs Have Limits:

Most jobs come with income ceilings. You can only work so many hours or climb so high in a company. Unless your in a situation where you’re in a smaller company where there are paths to ownership. - Unpopular Truth About Employment:

As an employee, you’re inherently betting against yourself. Your employer hires you because they believe they can extract more value than they pay you. That’s not a criticism; it’s business. Use your job as a stepping stone, not a destination. Please don’t let this be discouraging; it’s the starting point for everyone, we all need to build skills, generate income, and establish a strong foundation for future growth. - Employment is Paid Learning:

Think of your job as a paid education. It’s a chance to learn new skills, build relationships, and gain experience—all of which you can leverage later. Once you’ve maximized your role, seek new opportunities with higher responsibility or growth potential. Don’t get stuck in a routine that doesn’t challenge or reward you adequately.

A common phrase I often hear is, “I like my job, even though I know I could earn more.” That’s completely valid—living life on your terms is important. However, if wealth creation is your goal, you’ll need additional income streams. It’s worth asking yourself: do you truly love your job, or have you simply convinced yourself you do? Would you still show up tomorrow if you weren’t getting paid?

“Financial independence is the ability to live from the income of your own personal resources. Learn to convert your income into capital, your capital into enterprise, and your enterprise into wealth.” - Jim Rohn

Ownership and the Power of Multipliers ✖️

Wealth-building hinges on directing effort and resources toward inputs that yield disproportionately large outputs. Ownership, whether in business or real estate, offers a path to exponential returns, unlike the linear exchange of time for money in traditional employment.

- Employment:

- A job pays a fixed amount per hour or task, operating on a 1:1 input-output ratio. Your earning potential is directly tied to your available time and effort, creating an inherent cap. However, as an employee or contractor, you benefit from being paid first, and your financial downside is generally protected, offering stability and predictability not typically found in entrepreneurial ventures or asset ownership.

- Ownership:

- Equity owners are paid last, taking on both unlimited upside and unlimited downside, which can often lead to total loss in the event of failure (e.g., bankruptcy). However, owning assets—such as a business or real estate—fundamentally changes the equation by introducing a multiplier effect on returns:

Employment:

Every hour worked at $50/hour generates exactly $50 for that hour—no more, no less. The income is guaranteed, and you’re typically paid within two weeks, but that’s where it ends. There’s no potential for growth or additional value beyond the time spent working.

The Formula: Hourly Rate $50 X Hours Worked 1 = Income $50

Businesses:

Every dollar of EBITDA (Earnings Before Interest, Taxes, Depreciation, and Amortization) typically increases the business’s value by 5–10x or more. For example, $1 in EBITDA can equate to $5–$10 in enterprise value.

- Example: If you grow a residential or commercial cleaning business to $100,000 in annual net earnings, its value could range from $500,000 to $1,000,000, depending on the earnings multiple applied.

The Formula: EBITDA ($100,000) X Multiple (5) = Business Value ($500,000)

Real Estate:

Incremental improvements in Net Operating Income (NOI) have an outsized impact on value. Each additional dollar in NOI can boost property value by 10–20x or more, depending on market conditions and capitalization rates.

- Example: If you purchase a $500,000 property with a $30,000 NOI, and increase it to $60,000 NOI, the property value could increase from $500,000 to $1,000,000 or more by simplying increasing the Net Income by $30,000, depending on the market conditions and capitalization rate applied.

The Formula: NOI ($60,000) / Cap Rate (6%) = Property Value ($1,000,000)

The wealth generated through these multipliers can then be reinvested or borrowed against—often tax-free.

Leverage: ⚖️

Other examples of levers you can use for wealth multipliers include:

- Capital Leverage: Using other people’s money (OPM), banks, partners to scale investments.

- Code Leverage: No reproduction cost; automating processes for scalable impact.

- Media Leverage: Reaching vast audiences with minimal incremental cost.

- Labor Leverage: Delegating work to amplify productivity and profits.

The Key to Wealth: To create significant wealth, focus on activities and assets with built-in multipliers. This strategy transforms limited inputs into compounding outputs, setting the foundation for long-term financial freedom and scalability.

Taxation:

Employment income is taxed at the highest rates under a marginal tax system, with rates exceeding 50% for income above certain thresholds—typically over $200,000 annually. This effectively means that once you cross this threshold, you are working more than half the year for free.

I view this system as a form of “consumption tax,” where the government penalizes high personal earnings because that income is not being redistributed to benefit society. In contrast, businesses, real estate, commodity extraction, and other investments receive more favorable tax treatment. This is because the government designs the tax structure to incentivize job creation, housing development, and resource extraction. The rationale is that by taxing corporations and businesses less, profits left within these entities will be reinvested, fostering greater economic growth rather than being personally consumed.

One significant advantage of this system is the ability to control your personal tax rate by choosing how much to pay yourself each year. For instance, I personally pay myself the bare minimum to stay in an optimal tax bracket, allowing most of my business income to remain within the corporation at a lower tax rate. This approach enables me to reinvest that income and defer higher taxes until a later date, when I decide to draw on those funds and ring the “register.”

Rich VS Wealthy

There is a common misconception about the difference between being “rich” and being “wealthy.”

Rich people are often perceived as such because of their high income, typically from professions like doctors or lawyers. While they earn a substantial amount, they usually pay significant taxes due to their high salaries and may also adjust their lifestyle to match their income. This lifestyle inflation—larger homes, expensive cars, and lavish spending—can lead to a situation where they are dependent on their income to sustain their standard of living.

Wealthy people, on the other hand, are those whose wealth is measured by how long they can sustain their lifestyle without needing to work or earn a paycheck. Wealth is built on assets that generate income or appreciate in value, such as investments, real estate, or businesses. Unlike the “rich,” the wealthy often adopt a lifestyle that doesn’t inflate with their income, focusing on accumulating and leveraging assets.

In short, rich individuals often rely on their active income, while wealthy individuals have assets that provide passive income, enabling financial independence and long-term sustainability.

Mindset of Abundance:

An abundance mindset is essential for creating wealth because it shifts your focus from limitations to opportunities. When you believe that resources, opportunities, and success are plentiful, you open yourself up to new ideas, partnerships, and possibilities. This positive outlook fosters creativity and resilience, allowing you to approach challenges with confidence and innovative solutions. It also helps you avoid the fear-driven decisions that stem from a scarcity mindset, enabling you to take calculated risks and invest in your growth. Ultimately, an abundance mindset lays the foundation for long-term wealth creation by cultivating optimism, proactive behavior, and a willingness to share and collaborate.

Living Like a Student 🎓

For the next 4–7 years, your mantra is simple: Needs over Wants.

To achieve financial independence, you need far less than you think. Separate what’s truly necessary from fleeting desires.

I’ve written in more detail about how these key strategies can dramatically transform your financial trajectory, use the links below to read more:

Meal Prep: Did you know the average person spends thousands of dollars a year on eating out? Cooking at home and in bulk can cut those costs dramatically while giving you control over what you eat. It’s not just about saving money—it’s about building a habit that empowers you every day.

- Homemade meals are significantly cheaper and materially healthier than dining out or using pre-packaged options.

- Buy ingredients in bulk to reduce grocery costs and ensure access to fresh, wholesome food.

- Prepare meals in bulk to save time and effort, allowing you to enjoy home-cooked meals throughout the week.

- Stick to consistent meal choices to streamline the cooking process and reduce decision fatigue.

- As I’ve previously shared, I managed to reduce the cost of nutrient dense meals to $1-$2 per meal, while keeping my daily energy expenses under $5.

- The average cost of meal delivery services suchas Uber Eats and SkipTheDishes in Canada was $32 per order in 2024. Let’s face it—most of the time, that doesn’t even cover a full, satisfying meal. For the same price as one delivered meal, you could prepare 16 meals by buying and cooking in bulk, saving money and getting more value.

House or Rent Hack: Housing is one of the largest expenses for most people, up to 30-40% of expenses, but it doesn’t have to be. By House-hacking, Renting out extra rooms, sharing a home, or even living in a multi-unit property while renting out other units can slash your housing costs and free up funds for investments. It’s a smart, scalable approach to help you maximize your living situation during sacrifice phase.

- If you’re willing to go to extremes, like I did, aim to keep your housing expenses below $600 per month—or eliminate them entirely. With the strategies in this post, you can achieve “living for free.”

- For a more moderate approach, consider house-hacking a multi-unit property by living in one unit and renting out the others. This can significantly offset your expenses.

- For the most extreme option, house-hack or rent a 4+ bedroom house and lease out the extra rooms to long-term tenants or short-term guests (via platforms like Airbnb). Live in one room or even a shared space like a couch.

- Alternatively, if the option is still available, living at home remains the most affordable and comfortable choice, but you miss out on the opportunity to build wealth through property ownership and the skills that come with it.

- As I mentioned, I managed to reduce my housing expenses to just $177 per month by downgrading from a brand-new suburban home to a duplex in inner-city Winnipeg.

Transportation: Cars can drain your budget with payments, insurance, gas, and maintenance. By living close to work and choosing walking, biking, or public transit, you’re not just saving money—you’re gaining time and reducing stress.

- No one in this stage should own a car over $10,000. If you do, admit to yourself your trying to impress people you don’t even know.

- Buy used, pay cash. Stick with Hondas, Toyotas, Nissans, and other reliable brands.

- Bike and walk everywhere when possible.

- Relocate to an area where you can walk or bike to work and not be car dependent.

- As mentioned in the post, I started biking to work and everywhere else, using a cart to haul groceries, relocated closer to amenities, and downgraded my truck to a used RAV4 paid in cash, significantly cutting my transportation costs.

Avoid Lifestyle Inflation: It’s tempting to reward yourself with a better car, fancy dinners, upgraded house or luxury gadgets with every raise. But the truth is, material happiness is fleeting. Instead, redirect those extra earnings into investments that grow your wealth.

Avoid Debt: Avoid all forms of debt like the plague—treat it as a flashing red warning light demanding your attention. If you have debt, list what you owe by interest rate, starting with the highest, and prioritize paying it off aggressively. Never finance consumer goods—it’s a financially reckless move. If you feel the urge to make an impulsive purchase, practice restraint by waiting four weeks. More often than not, the desire will fade, and you’ll realize it wasn’t worth it. I promise, this simple habit can save you from countless unnecessary expenses.

The only time you should consider going into debt is when the money you borrow directly contributes to building wealth. Borrowing money to make money is one of the most powerful tools for accelerating wealth. Why? Because borrowed money doesn’t require your labor to earn, and it’s not taxed as income. If you can invest it in assets that generate returns exceeding the borrowing cost, you keep the spread.

When used wisely, debt can turbocharge your wealth-building strategies, allowing you to grow your portfolio faster than relying solely on earned income. However, this requires discipline and careful analysis to ensure the returns justify the risks. More on this later.

View Sacrifice as Temporary: Frugality doesn’t mean giving up on comfort forever. Think of it as a short-term strategy for long-term freedom. The small sacrifices you make now—skipping the designer coffee, holding off on that dream car—are investments in a future where you can live life on your terms.

Once you recognize that your freedom is for sale every day, the choice to skip swiping your credit card for that designer watch or handbag becomes clear.

Frugality

Frugality isn’t about being cheap—it’s about understanding and prioritizing value. True frugality means making intentional decisions with your money, focusing on what truly matters and brings you joy, rather than mindlessly cutting costs or avoiding spending altogether. It’s about recognizing the difference between price and worth, and allocating resources to areas that align with your goals and values. For instance, you might choose to invest in high-quality items that last, while forgoing frivolous purchases that add little to your life. Frugality is a mindset of maximizing your resources, not depriving yourself, and it empowers you to build a life of abundance and purpose without waste.

Playing Status Games: The Cost of Keeping Up

In today’s media-driven world, it’s easy to fall into the trap of playing status games—constantly comparing yourself to peers and striving to match their lifestyles. Whether it’s splurging on the latest gadgets, designer clothes, or luxury vacations, trying to “keep up” often comes at a steep cost, both financially and emotionally.

The truth is, chasing status rarely leads to genuine happiness. It’s a fleeting high, driven by external validation rather than personal fulfillment. Meanwhile, the pressure to maintain appearances can drain your bank account, leaving you stressed, overworked, and unable to focus on your long-term goals.

True satisfaction comes not from outspending or outshining others, but from defining success on your own terms. By prioritizing what truly matters—authentic relationships, personal growth, and financial stability—you can break free from the exhausting cycle of comparison and find lasting contentment.

Let go of the race to impress, and instead, invest in a life that reflects your values, not someone else’s highlight reel.

“People who live far below their means enjoy a freedom that people busy upgrading their lifestyles can’t fathom.” - Naval Ravikant

Final Thoughts

It’s important to understand that saving alone has its limits—you can only cut expenses so much. That’s why in the next sections, we’ll focus on strategies to maximize your income. Unlike saving, your earning potential is virtually unlimited—you could earn millions or even billions per year if you build the right systems and opportunities.

Early on, it’s essential to keep your expenses tight, as this creates the foundation for wealth building. However, as your income grows, your baseline needs typically remain fixed, making your expenses a smaller percentage of your total earnings over time. This shift allows you to focus more on scaling your income while maintaining financial discipline. By balancing both saving and earning, you can accelerate your journey toward financial freedom.

Part 2: Building the Financial Base 🌱

The foundation of retiring in 7 years or less lies in building a robust financial base. This requires saving aggressively, making smart investments, and utilizing strategies to grow your income and wealth exponentially. Here’s how to do it.

The Number

Achieving early retirement starts with figuring out your “number”—the amount of money you need to reach financial independence. This number represents the assets or income streams required to cover your living expenses indefinitely without needing to work. I’ve covered this concept in detail in my blog post The Simple Math of Early Retirement, breaking down how to calculate your number based on your goals, lifestyle, and preferred retirement timeline. Be sure to check out the full post for a comprehensive guide to determining and achieving your financial independence.

Rule of thumb, your number should be 25x your annual expenses.

Most assets allow the investor to withdraw 4% per year, so if you can live off 4% of your net worth, you can retire while the underlying assets contiune to grow.

The Power of a High Savings Rate

If you want to achieve financial independence quickly, you need to save aggressively—think 50%, 60%, or even 75% of your income. While this might sound extreme, it’s achievable with the right strategies. Here’s why it works:

Exponential Growth: The more you save, the faster your money compounds. A high savings rate doesn’t just shorten your timeline; it also amplifies your wealth-building efforts.

- 5% savings rate, retire in 65 years

- 20% savings rate, retire in 36 years

- 50% savings rate, retire in 16 years

- 60% savings rate, retire in 12 years

- 75% savings rate, retire in 7 years

- 80% savings rate, retire in 5 years

How to Achieve It

- Increase Income: Inrease skills, become worth more to the marketplace. Work multiple jobs, take on side hustles, and/or build a business.

- Invest Wisely: Become an equity owner in businesses (stocks) and real estate.Pay yourself first, before spending on expenses. The moment you get paid, the first transfer should be to your investments, suchas DCA into low-cost index funds, and transfer into real estate, and businesses once you have enough saved up.

- Avoid Lifestyle Creep: Resist the urge to upgrade your lifestyle as your income grows.

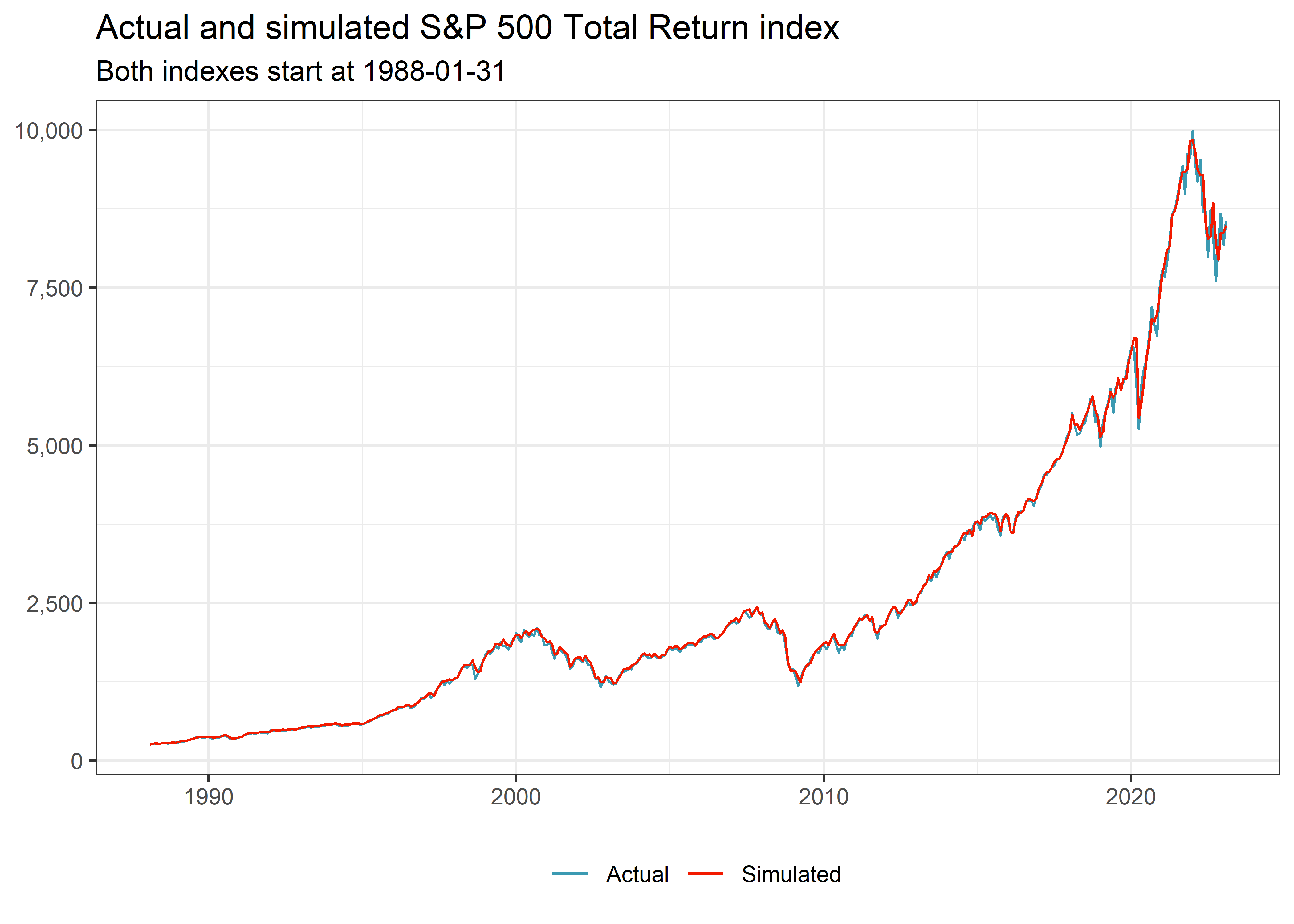

Index Investing for Growth 📊

Once you’ve saved aggressively and optimized your living costs, it’s time to grow your money through investments. Focus on simple, proven strategies that maximize returns over time.

The strategy is straightforward: Dollar-Cost Averaging (DCA). Once you’ve determined your savings rate and decided how much you want to allocate each month, set up a self-directed trading account to automatically invest in broad-based, low-cost index funds, such as Vanguard’s S&P 500 options.

Start by maximizing contributions to tax-advantaged accounts like TFSAs and RRSPs. Once those are fully utilized, build additional investments through standard self-directed accounts.

For Canadians, I recommend Wealthsimple—it’s a user-friendly platform that is simple to navigate and easy to set up, making it an excellent choice for beginners and experienced investors alike.

I personally use Interactive Brokers for my trading account, as it caters to experienced investors rather than beginners. This platform is ideal for those familiar with the markets and interested in trading complex strategies like call options, derivatives, or using margin. Additionally, I have self-directed accounts set up for each of my holding companies, a feature not typically offered by consumer platforms like Wealthsimple. This setup allows me to manage both personal and corporate portfolios seamlessly through a master advisor account, which consolidates all portfolios into a single dashboard for streamlined oversight.

- Index Fund Investing:

- Allocate a portion of your savings to low-cost index funds, like those tracking the S&P 500.

- Historical returns average around 10% annually, compounding your wealth effectively.

- Stop searching for the needle in the haystack (indivudal stock picking)—just buy the entire haystack. By chosing to purchase the S&P 500, you end up owning a small piece of the top 500 companies in America. Betting against America is a losing proposition.

- Utilizing Tax-Advantaged Accounts:

- Maximize RRSP (Registered Retirement Savings Plan) contributions to reduce taxable income and grow your investments tax-free.

- Reinvest tax savings to accelerate your wealth-building.

- Compound Growth in Action:

- Example: Investing $25,000 annually in an index fund at a 10% return can grow to nearly $290,836 in 7 years, even without adding additional principal.

Over 10 years, the total portfolio would grow to $475,228,

Over 20 years, the total portfolio would grow to $1,694,014,

Over 30 years, the total portfolio would grow to $4,993,320.

I reccomend playing around with this Compound Interest Calcuator to visualize the power of compound interest and the impact that adjusting your savings rate and time horizon can have on the final outcome.

Housing Hacks and other Real Estate Strategies 🏘️

Primary residences come with much more favorable financing options, allowing you to purchase a property with as little as 5% down using CMHC-insured loans. Contrary to popular belief, these loans can be used up to three at a time. To obatin more, you must refinance out of one of the last ones before applying again.

These lending programs are highly advantageous for individuals who occupy their homes as their primary residence. By combining these opportunities with strategies like buying small multifamily properties—such as duplexes—or converting a single-family home’s basement into a rentable suite, you can create an excellent foundation for building wealth for little money down. Acquiring one of these properties every year or so can significantly accelerate your financial growth.

Housing costs often consume the largest portion of your income. By hacking your housing situation, you can save significantly and even generate income. Here are some strategies:

- House Hacking: Buy a duplex or triplex, live in one unit, and rent out the others. Use low down payment loans (e.g., 5%) to make it accessible.

- Rent Hacking: Share a rental with roommates or rent out unused rooms to reduce living costs.

- Renovation Credits Group in Purchase Plus Imporvements Loans or Cash on Close Programs, this is where the bank will provide additional financing for the renovations or cash back at closing to reduce your cash outlay.

- Creative Property Acquisition:

- Seller Financing: Negotiate terms directly with property owners.

- Raising Capital: Partner with investors to purchase properties.

- Buying One Property a Year: Build a real estate portfolio gradually, leveraging equity and appreciation over time.

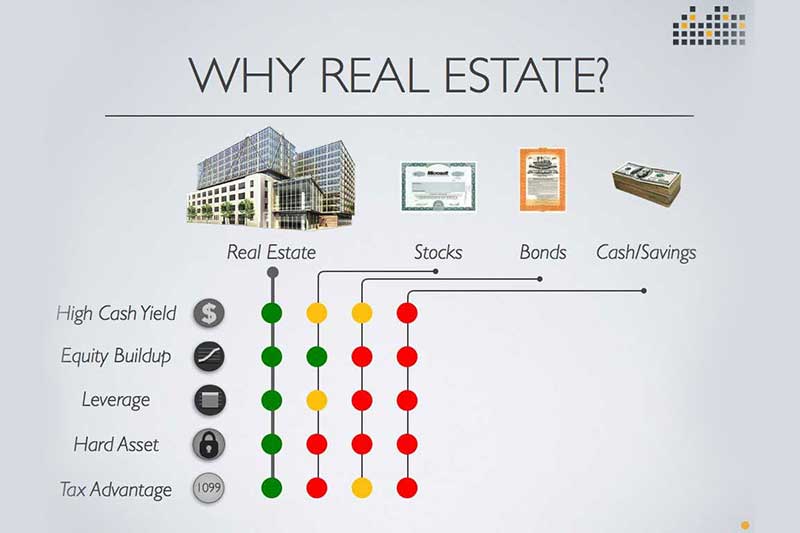

Why Real Estate?

- Income Generation: Rental properties can provide steady monthly cash flow.

- Tax Efficiency: Real estate offers numerous tax benefits, such as depreciation.

- Leverage: Use borrowed money to control appreciating assets. Easiest asset to finance.

- Increase Value It’s easy to learn stratgies to force appriecation.

- Low Risk: Residential real estate will never go to zero, it will always hold value, and your never margin called (forced to sell).

- Hard Asset: Real estate is a hard asset, providing intrinsic value as a tangible and physical property that can serve as a hedge against inflation and market volatility.

- Low Volatility: Real estate typically experiences lower volatility compared to other asset classes due to its relative illiquidity, providing more stable and predictable returns over time.

If you’re not interested in managing real estate directly or lack the required expertise, it’s often wiser to partner with experienced professionals by participating in real estate deals as a limited partner (LP). Attempting to go solo may lead to lower returns and way more work compared to partnering passively with skilled investors who act as General Partners (GPs). These GPs typically have access to superior deals, experienced teams, and the expertise needed to achieve better performance, making them more likely to outperform individual efforts.

Most people have no business being landlords because they don’t understand the fundamentals of the business model. Many assume it’s as simple as buying a property and renting it out, without understanding how to:

- Properly manage the property.

- Accurately assess its value.

- Analyze financials and run the numbers correctly.

- Do not have enough experiance to appropriately assess risk.

- Negotiate favorable financing terms.

As a result, most landlords lose money on a cash flow basis and rely solely on long-term appreciation to make up for their losses. This is risky and unsustainable. For instance, a commonly overlooked metric is the 1% rule, which states that the monthly rent should be at least 1% of the property’s value. Properties that fail this rule are almost guaranteed to lose money every month—yet few investors adhere to it.

How to Learn Real Estate Investing

If you are willing to learn these essential skills, you can succeed by leveraging free resources, here are some key steps and tools to get started:

- 1. Learn to Underwrite and Analyze Deals

- Consistently evaluate and analyze properties in your target market.

- Study market trends and property performance metrics.

- Learn to project income and anticipate expenses accurately.

- Memorize operating costs and the going rent in your target market.

- Master underwriting processes to ensure sound investments.

- Research and secure appropriate financing options for different deals.

- Learn how to conduct proper due-dilligence.

- You’ll evetnaully get to a point where you’ll be able to look at a property and within a few seconds be able to determine if it’s a good deal or not.

- Deterimine your niche, investment strategy and return expectations.

- 2. Network with Industry Professionals

- Meet with local experts (e.g., Realtors, brokers, appraisers, bankers,property managers) over coffee or lunch to gain insights.

- Build relationships with other investors and gather real-world knowledge. Join online and local real estate investor groups.

- 3. Walk Properties with Professionals

- Tour properties with Realtors and brokers to understand property conditions and potential.

- Gain hands-on experience assessing property value and market fit.

- 4. Develop Property Management Skills

- Learn best practices for managing tenants and day-to-day operations.

- Study maintenance, tenant relations, taxfilings and legal responsibilities.

- 5. Focus on Property Improvements

- Identify opportunities to enhance properties and force appreciation.

- Plan upgrades that increase property value and attract better tenants.

My Approach to Real Estate Investing

When purchasing properties, my priority is ensuring they generate strong cash flow with a comfortable margin, while factoring in potential fluctuations in interest rates and vacancy levels. I don’t speculate on market trends or buy properties based on the assumption that their value will naturally increase over time.

I do not buy real estate becasuse it will increase in value, I buy real estate because I force it to increase in value by improving it. My investments are driven by certainty, not by gambling on market movements. I focus on acquiring properties below replacement cost and intrinsic value, ensuring that from day one, I know I made money.

“The best exit strategy is a good purchase” - Robert Kiyosaki

Secondly, I strive to recover my initial investment within 2–3 years, primarily through refinancing rather than relying solely on cash flow. Keeping equity tied up in a property reduces the return on equity (ROE), so my approach emphasizes extracting that equity and replacing it with debt to fund future opportunities. This is why value-add strategies are a cornerstone of my investment methodology.

My High-Level Rules for Evaluating Real Estate Deals by Strategy 🧪

Flips:

- Aim to purchase properties at a maximum of 80% of their eventual sale price, as determined by comparable sales (“comps”) from the last six months. This 80% must account for the purchase price, transaction costs, holding costs, renovation expenses, and selling costs.

Basic Rentals (No Value-Add):

- The property should generate monthly rent equal to at least 1% of the purchase price. If it doesn’t meet this threshold, it likely won’t cash flow on a monthly basis.

Short-Term Rentals (No Value-Add):

- Focus on properties with a Gross Rent Multiplier (GRM) of 5 or lower. GRM = Purchase Price / Annual Gross Rental Income.

Apartment Deals (BRRRR Strategy):

- Look for stabilized yields at least 200 basis points (bps) above the market cap rate. The higher the spread, the better the deal.

Quick Deal Analysis Formula:

- Market Rent × Unit Count × 12 months × 95% occupancy = Revenue

- Revenue × Market NOI Margin = NOI

- NOI ÷ (Purchase Price + Renovation Costs) = Stabilized Yield

To BRRRR effectively, acquire properties for an all-in investment cost of no more than 75% of their final appraised value with market rents and optimized expenses. This ensures that the remaining 25% equity can be “forced” through improvements and refinanced out, allowing you to hold the property with minimal out-of-pocket cash post-refinancing.

Commercial Real Estate (CRE):

- PSF Analysis:

- Compare the price per square foot (PSF) with similar properties in the area. If a property is significantly undervalued relative to comparable properties with similar cap rates, it may present an opportunity to add value through rent repositioning or operational improvements.

- For example, if most properties sell for $400 PSF, but one is listed at $200 PSF with a similar cap rate, it might be a chance to add value by raising rents to market and–or fixing inefficiencies. PSF simplifies the initial search, highlighting promising deals for deeper analysis.

- Vacancy Opportunity:

- Identify buildings with some vacancy, as filling these spaces can significantly boost income. CRE values are based on income rather than comps like residential real estate. A building with little to no income defaults to land value minus demolition costs and requires all cash to purchase, as banks won’t lend on non-income-producing properties.

- If some income exists, bank financing can be secured based on the properties ability to debt service, allowing for leverage. Each additional $1 in NOI typically translates to $15–$20 in building value. This leverage creates opportunities to refinance and extract initial equity, often acquiring CRE for “pennies on the dollar.”

Creative Financing:

- Lastly, creative financing: In any real estate niche, I’m always open to securing favorable terms—whether through lender restructuring, seller negotiations, or partnerships—to acquire cash-flowing properties with no money down. This approach is all about building long-term wealth by acquiring assets. When combined with value-add strategies, it becomes a powerful formula for success.

By focusing on these principles and strategies, you can evaluate deals quickly and effectively while maximizing returns across different real estate types.

📚 Resources:

- BiggerPockets Podcasts Listen to every episode between years 2014-2018

- BiggerPockets Forums

- BRRRR Method: Buy, Rehab, Rent, Refinance, Repeat

- Crushing it in Apartments and Commercial Real Estate: How a Small Investor Can Make It Big

- Cash Flow Quadrant

- Book on Estimating Rehab Costs

- Real Estate Joint Ventures: The Canadians Guide to Raising Money and Getting Deals Done

- Adventures in CRE (A.CRE) - Real estate modeling and RE career advancement

The Magic of Real Estate + Index Investing 📈

Combining real estate and traditional investing creates a powerful dual engine for wealth creation:

- Real Estate: Provides immediate cash flow and long-term appreciation.

- Investments: Offers liquidity and consistent compounding over time.

- Uncorrelated Assets: Offer the advantage of reducing risk through diversification. By spreading investments across assets that do not move in tandem with one another, you can hedge against potential losses in any single market or sector. This strategy helps stabilize overall portfolio performance, as gains in one area can offset declines in another, ensuring more consistent returns over time.

- Low Effort: Both real estate investing and low-cost index fund investing require minimal time and effort compared to alternatives like starting or buying a business, while also presenting significantly lower risk. Don’t get me wrong—businesses can be fantastic investments, often yielding the highest returns, but they demand a significant amount of time, effort and personality types to manage successfully.

By balancing these two asset classes, you can diversify risk while accelerating your financial independence timeline.

Part 3: Career Strategies for Rapid Growth

Building wealth in 7 years requires more than just saving—it’s about maximizing your earning potential and strategically leveraging your career to accelerate financial growth. Whether you stick to traditional employment or explore alternative paths, this section will guide you through the steps to level up your income.

Breaking Through Income Ceilings

Many jobs often come with pay ceilings, limiting your earning potential. To break through these barriers, you need to take control of your career trajectory. Here’s how:

- Solve Bigger Problems: Your income is directly tied to the size and complexity of the problems you solve. Expand your skill set and take on roles that require greater expertise.

- Apply for Higher-Responsibility Roles: If your current role has limited growth opportunities, seek positions at other companies where you can advance.

- Never Stop Learning: Treat every job as an opportunity to gain new skills and knowledge that you can leverage for higher-paying and exciting opportunities.

- Avoid the 40-40-40 Trap: Many people fall into the “40-40-40 death pledge,” where they work 40 hours a week for 40 years to retire on 40% of their income. Break free by prioritizing growth over comfort.

Build Specific Knowledge

Specific knowledge refers to deep, non-transferable expertise or unique skills that are difficult to automate or replicate. This type of knowledge often involves creative thinking, problem-solving, the ability to generaate good returns on capitral, or specialized technical ability, making it highly valuable in the marketplace. Examples include programming, design, entrepreneurship, medicine, high-level engineering, or roles requiring nuanced judgment and experience.

- Unlimited Earnings Potential: Specific knowledge often allows for entrepreneurship or roles where earnings are tied to value created, not hours worked. For example, a consultant can charge premium fees because their insights lead to significant business outcomes.

- Access to Leverage: Specific knowledge allows individuals to work with scalable tools—like software or capital—amplifying their efforts.

Specific knowledge involves unique, hard-to-automate skills like problem solving, investing, design, or entrepreneurship, which command higher earnings and leverage through creativity and scalability. In contrast, repetitive jobs are routine, easily automated, and offer capped earnings due to high supply, low barriers to entry, and limited differentiation. Training for specific knowledge future-proofs careers, unlocks unlimited income potential, and allows individuals to escape the “time-for-money” trap, offering greater job security and personal freedom.

Warren Buffett exemplifies the value of specific knowledge and judgment, with his unique ability to evaluate businesses, foresee value, and make sound long-term decisions earning him unparalleled trust. Unlike algorithms or basic analyses, his deep expertise and nuanced judgment consistently yield exceptional returns. As a result, investors are eager to line up and entrust him with billions of dollars.

The same logic applies to C-suite employees suchas CEOs, often sparking debates about their high compensation, which can reach tens or even hundreds of millions of dollars. While this may seem unfair compared to employees earning minimum wage, consider the replaceability factor. For example, it’s far easier to replace a minimum-wage employee than someone like Jamie Dimon, CEO of JPMorgan Chase, who has steered the company to generate over $50 billion in net income and a 17% return on equity. From a shareholder perspective, paying $30 million to a leader who delivers such results is a obvious investment. CEOs like Dimon possess rare, specific knowledge and skills to manage thousands of employees, navigate complex regulations, and oversee massive public corporations—all while sacrificing significant personal time. Their compensation reflects the immense value they bring and the difficulty in replacing them.

A formal education will make you a living; self-education will make you a fortune. - Jim Rohn

How to Get Almost Any Job

Offering to work for free is a powerful strategy to break into almost any career, reviving the old apprenticeship model. For jobs that don’t require government-mandated credentials, this approach can open doors that seem otherwise inaccessible. By volunteering your time for 1–3 months, you demonstrate unparalleled confidence, dedication, and a willingness to learn—qualities employers find invaluable. It provides an opportunity to gain hands-on skills, understand the role, and prove your value before discussing compensation. When proposing this arrangement, frame it as a trial period: “Let me work for you for free to learn and contribute. At the end of this period, we can review whether I’ve added enough value to warrant being paid, and if not, I’ll walk away with gratitude for the experience.” This method has worked for me every time and guarantees you a foot in the door for any career path. - Another reason to keep your burn rate low is to ensure you’re ready to seize opportunities like these when they arise.

Climbing the Ranks

The key to advancing quickly in any job is to set aside entitlement and focus on making your superior’s job easier. Whether you report to a supervisor, manager, or CEO, your role is to support them effectively. This mindset is often recognized and rewarded. For example, when I apprenticed under a journeyman pipefitter, I arrived early to ensure all tools were charged, organized, and ready, paperwork was completed, and even coffee was prepared. By anticipating their needs and creating a seamless workflow, I made their day more efficient. Additionally, by observing and understanding their patterns and steps, I could predict their next moves and proactively assist. This level of preparation and foresight not only makes you indispensable but also demonstrates your potential, earning respect, trust, and faster career advancement.

Pension Trap

It’s fascinating when people justify staying in a job by saying, “Oh, it’s a good job because of the pension.” The thought of enduring a 40-year career solely for the chance at a pension that may provide a modest income in retirement seems like a risky gamble. Why place your future in a system that has repeatedly failed, with both public and private pensions going bankrupt and leaving people stranded? Pensions are not guaranteed. Instead, focus on building multiple income streams, diversifying your skill sets, and taking charge of your financial future.

If you calculate how much of your paycheck is contributed to your pension and reverse-engineer the math, investing that same amount over the same time frame at the average stock market appreciation rate, you’d end up with a monthly withdrawal amount approximately 50% higher. Plus, you’d retain full access to your entire nest egg, which could grow to $2–3 million over a 30-year career.

Pensions operate on the same principles I’m discussing here. Money from workers is pooled together, and a fund is created to invest that capital. These funds incur significant administrative costs—typically 1–3% of the total asset value annually—to manage the money. The asset managers then invest in a diversified portfolio that often includes stocks (like the S&P 500), bonds, real estate, fund-to-fund private equity deals, infrastructure projects, and occasionally smaller positions in venture capital or alternative investments.

The key advantage of pensions is their scale, which gives them access to better deals and opportunities that might not be available to an unskilled individual investor. However, my argument is that you can learn the basic skills required to manage your investments relatively easily. Even if you prefer not to manage it yourself, hiring a financial advisor to oversee your portfolio is far less costly than the bloated operational expenses of a pension fund and you remain in full control of your nest egg.

Ultimately, the returns (if any) generated by the assets in a pension are distributed to retirees. By cutting out the middleman, managing your investments yourself—or outsourcing to a cost-efficient financial manager—you can retain full control, reduce expenses, and likley achieve greater results. If you had simply invested (DCA)in the S&P 500 index starting at any point since its inception, you would have outperformed every pension fund.

Ontario Teachers’ Pension Plan 2023 returns fall short, 1.9% return

The S&P 500 return for 2023 was 26.29%

The Risk of Relying on Employment

I once found myself sitting next to a pilot on a flight, and as we exchanged stories about our careers, he confided that he could never do what I do. The idea of working for himself and investing in real estate seemed far too risky to him. I smiled and replied with respect, admitting I felt the same way about his career. For me, relying on a single employer as my only source of income felt much riskier than diversifying across multiple, uncorrelated income streams.

To me, true security lies in spreading out risk. A job can vanish overnight—you can be fired or laid off without warning. But when you own a well-structured business or investment portfolio, the income can keep flowing even in your absence. In your own business, the decisions are yours—the buck stops with you. There’s no new manager or boss trying to prove themselves by slashing costs or redefining your role. You’re in control of your destiny, not at the mercy of someone else’s decisions.

The Fear of Change & The Great Adventure

Many people feel wired—or scared—into staying with their current employer, often paralyzed by the fear of handing in their two weeks’ notice and venturing into something new. This fear might stem from societal conditioning, where sticking with a job, even one you don’t enjoy, is seen as a badge of perseverance, especially if you’ve been there for a long time. However, this mindset can hold you back if your goal is to optimize personal growth, wealth, and career trajectory. The moment a job stops challenging you or fails to compensate you fairly for the value you bring, it’s a clear signal to move on.

The first step might be seeking advancement within your current company, but if that’s not an option, broadening your search for roles with greater responsibilities, new skills to master, and expanded networking opportunities is essential. As an employer, I prioritize challenging my employees, rewarding their efforts with increased compensation, and eventually offering ownership opportunities to foster both growth and loyalty. If your current employer doesn’t value you in similar ways, it’s worth exploring new opportunities that align better with your aspirations. Don’t let fear keep you in a role that limits your potential—switching it up can be the catalyst for incredible personal and professional growth.

Using a well-known biblical analogy, the story of Abraham. God calls Abraham to leave his homeland, his family, and everything familiar to him, saying:

“Go from your country, your people, and your father’s household to the land I will show you. I will make you into a great nation, and I will bless you; I will make your name great, and you will be a blessing.” (Genesis 12:1-2)

The message this analogy is trying to portray is that Abraham embarks on this journey with little certainty about what lies ahead, but his faith propels him forward. This story symbolizes the adventure of life—the willingness to embrace the unknown, guided by faith and the promise of growth, purpose, and fulfillment. It reminds us that stepping out of our comfort zones, though daunting, is often where the most meaningful experiences and opportunities arise. The “great adventure” isn’t just about arriving at the destination; it’s about the transformative journey itself.

Growth is on the other side of fear.

“You can have more than you’ve got, because you can become more than you are.” - Jim Rohn

Alternative Career Paths

If your current job isn’t providing the growth or income you need, consider these alternative paths to boost your financial progress:

- High-Paying Industries:

- Explore high-demand fields like software development, finance, comissions based sales or trades (e.g., oilfield work).

- Relocate to a larger city or region where higher-paying opportunities are available.

- Consider applying to startups or early-stage companies before their first major funding rounds. These roles provide excellent opportunities to build diverse skills, work across multiple functions, and expand your network. They may also offer potential stock options. To discover startups in your area, explore resources such as press releases, Crunchbase, LinkedIn, and local startup communities.

- For instance, I’d gladly choose to be the 100th employee at Facebook in the earlier days rather than joining an already established company. The 100th employee at Facebook received 2 million shares pre-IPO, which later became worth over $76 million. Similarly, being an early employee at a company like SkipTheDishes, Tesla, or Shopify would offer tremendous potential.

- Usually, it’s better to join the winning team than to start a company from scratch—especially if you’re not truly passionate about the idea.

- Starting a Business:

- Launch a business if you have an idea that solves a clear problem or fills a gap in the market.

- While risky, entrepreneurship offers the highest potential for rapid income growth if executed well.

- Examples: service based businesses, freelancing, consulting, or e-commerce.

- 100 Low Risk Businesses I Love That Can Be Started with Little Money

- If your idea requires a modest investment, consider raising funds from friends and family, leveraging existing assets, or exploring government grants and subsidies for new businesses, like those offered by Futurpreneur Canada.

- Creative Financing for Business Ownership:

- Seller Financing: Purchase an established business using creative financing strategies to start generating income right away with no or low money down. This powerful approach is highly effective yet often overlooked and underutilized.

- Raising Capital: Partner with investors to acquire or start a business while covering your base living costs with management fees while you grow the business. Example: Search Fund.

- Side Hustles:

- Start small, scalable ventures alongside your main job.

- Popular options include freelancing, tutoring, or selling online.

- Grow organically, reinvesting profits back into the business without taking on debt.

Buy Then Build

Buy Then Build by Walker Deibel advocates for acquiring an existing business as a faster and more reliable path to entrepreneurship compared to starting one from scratch. The book explains how buying a business provides a proven model, existing cash flow, and an established customer base, significantly reducing the risk and time required to achieve success. Deibel outlines strategies for identifying the right business, financing the acquisition, and scaling it effectively, offering actionable insights for aspiring entrepreneurs to leverage acquisition as a growth strategy while building long-term wealth.

Another great interview on buying a business with no experiance and no money: How I Bought A Multi-Million Dollar Business For $0 | Sarah Moore Interview

Leveraging Multiple Income Streams 💰

Combining multiple income streams can drastically speed up your timeline to financial independence:

- Salary + Side Hustle: Use your job for stability and your side hustle for additional cash flow.

- Salary + Real Estate: Acquire income-generating properties while maintaining your primary income source.

- Salary + Business with Exit Plan: Start a business part-time with a goal of transitioning to full-time once it’s profitable.

Example Pathway:

- Work a job with potential to contiunally grow your income, your network and skills.

- Live below your means and save aggressively. (Needs VS Wants)

- Start a side hustle, business, and/or acquire real estate properties.

- Scale side income until it equals or surpasses your primary income.

The Value of Building a Network 👥

Your career success isn’t just about skills—it’s also about who you know. Building a network of professionals in your industry or financial ecosystem can open doors to opportunities you might not have considered:

- Learn from Mentors:

Seek out people who’ve achieved what you’re aiming for and learn from their experiences. - Expand Your Network:

Attend industry events, join local and online communities, and connect with peers who can help you grow. Ask people you know out for coffee or lunch (make sure your pay and attempt to provide them value, do not just take).

Avoiding Lifestyle Traps 🚗

As your income grows, resist the temptation to upgrade your lifestyle. Every dollar you don’t spend can be invested to build your financial future:

- Delay large purchases like new cars or luxury items.

- Focus on needs over wants, and save excess income aggressively.

- Treat every raise as an opportunity to save more, not spend more.

Housing is a Lifestyle Purchase, Not an Investment: 🏡

A primary residence is a consumer good, not an investment. If your home isn’t generating income (house-hack), it’s making you poorer. Renting, paired with investing with the average return of the stock market, often outperforms traditional homeownership financially.

The true cost of owning a home far exceeds renting when factoring in opportunity costs, reduced financial flexibility, and mobility. Delay purchasing a home until you can afford the down payment without significantly impacting your finances and can keep your total monthly housing expenses—including mortgage payments, taxes, utilities, and maintenance—below 15% of your net income. Let your assets, not your income, fund your housing and lifestyle.

Why Career Strategy Matters

A well-planned career can provide the income and opportunities needed to reach financial independence in record time. Whether you’re climbing the corporate ladder, transitioning to entrepreneurship, or balancing multiple streams of income, the key is to stay focused on growth.

Part 4: Advanced Strategies for Wealth Creation

Once you’ve built a financial base and maximized your income, it’s time to supercharge your journey with advanced strategies. These methods focus on leveraging capital, managing assets, and using scalable wealth-building techniques to accelerate your path to financial freedom.

Creative Financing and Asset Management

Building wealth quickly often requires thinking beyond saving and basic investing. Leveraging creative financing and effective asset management can multiply your efforts.

Raising Capital for Real Estate or Businesses: (optional)

- My Personal Favorite: The ultimate strategy for creating wealth:

- Identify an asset with potential for improvement. (business, real estate, etc.)

- Use Other People’s Money (OPM) Debt, Equity, Banks, Vendors, Partners to acquire it.

- Share the returns with investors or partners.

- Repeat the process.

Partner with Investors:

Find individuals or groups willing to fund your real estate or business ventures. Offer them a share of the returns while you manage the project.

- However, at this stage, think of yourself as essentially applying for the role of Financial Manager for someone else’s assets. To succeed, you must develop the necessary skills, build a strong reputation, and demonstrate unwavering integrity to earn the trust required to manage other people’s money. This responsibility isn’t for everyone, and it demands a high level of expertise and accountability.

Seller Financing:

Negotiate directly with property or business owners to structure deals with minimal upfront costs, giving you control of income-generating assets faster.

Management Fees: (optional)

- When raising capital, build management fees into your projects to cover expenses while you focus on scaling the business or investment.

- Buy one property per year using creative financing or low-down-payment options, building a portfolio that appreciates over time.

Scaling Business Ventures: (optional)

- Once a business is profitable, reinvest earnings to grow operations.

- Expand into complementary areas or products to diversify income streams.

Using Leverage in Real Estate:

Historically, housing appreciates at about 3% per year, with an additional 3% per year in net income, resulting in a total return of 6%. If you pay cash for the house, your return is limited to that 6%. However, by using leverage (bank financing), you could buy five houses with 20% down on each, spreading your initial investment across multiple properties. Each house would still generate the same growth, but because you’re using less of your own money for each property, the return on your capital is multiplied.

In this scenario, with 3% appreciation, 2% debt paydown, and 1% cash flow, your total return on capital could exceed 25% annually, compared to just 6% if you paid cash. And this doesn’t even factor in more creative financing strategies such as using the OPM, seller financing, 5% down loans or efforts to force appreciation, which could boost your returns further.

1 house for $100k VS 5 houses for $20k down, control $500k in assets VS $100k

1 house for $100k VS 5 houses for $20k down, control $500k in assets VS $100k

Money People Deal (simple theory behind raising capital)

A great simple explainer, in Money, People, Deal, Stefan Aarnio introduces the “Money-People-Deal Triangle” a framework that identifies three core elements required for success in real estate investing and business and how you can bring The People (knowledge) and The Deal together to attract The Capital from money partners:

- Money:

- Capital is the lifeblood of any venture. Whether it’s personal savings, investor funds, or creative financing strategies, having access to money is critical for acquiring assets and pursuing opportunities. Aarnio stresses financial literacy and leveraging other people’s money (OPM) to scale effectively.

- People:

- Relationships and networks are essential for finding deals, securing funding, and managing operations. Building a team of trusted professionals—such as realtors, lawyers, contractors, and investors—along with maintaining strong personal connections, can amplify your success. Aarnio emphasizes the importance of influence, leadership, and negotiation skills in dealing with people.

- Deal:

- This represents the opportunities themselves, whether it’s finding undervalued real estate properties, structuring win-win transactions, or closing strategic business agreements. Aarnio highlights that recognizing and creating value through deals is a skill that separates successful entrepreneurs from the rest.

Aarnio’s triangle works as a system: if you lack one element (e.g., money), you can use strength in another (e.g., people or deals) to compensate. For example, a great deal can attract money, or a strong network can help secure capital or opportunities. By mastering the balance between money, people, and deals, you create a sustainable model for long-term success in business and investing.

The Snowball Effect

As your investments grow, you’ll notice a compounding effect: the more wealth you accumulate, the faster it grows. Here’s why:

- Compounding Returns:

- Each dollar reinvested generates additional income, creating exponential growth.

- Scaling Assets:

- Once your portfolio reaches a critical mass, it generates enough cash flow to fund further investments without needing additional contributions.

- Example:

- Saving $100,000 might take several years, but with consistent investment growth, reaching $1,000,000 happens much faster.

- This snowball effect accelerates as you reinvest gains into high-yield opportunities.

Achieving Financial Flexibility

Once your baseline expenses are covered through asset income, you’ve unlocked true financial independence. At this point, you can:

- Pursue Passions:

- Shift focus to work or projects that excite you, regardless of pay.

- Experiment with Careers:

- Try new roles, start a dream business, or return to an enjoyable past job without financial pressure.

- Enjoy Your Freedom:

- Spend more time on hobbies, family, and experiences.

Challenges and How to Overcome Them

- Learning Curve:

- Real estate, investing, and business management come with challenges. Invest time in learning the basics and seek mentorship when needed.

- Balancing Risks:

- While leveraging capital can be powerful, it also increases exposure to risk. Ensure you have a buffer of emergency funds and avoid overextending yourself.

Why These Strategies Work

Advanced strategies like leveraging capital, scaling assets, and optimizing investments unlock levels of growth that traditional saving cannot achieve alone. By strategically managing your assets and capital, you create a financial system that works for you, allowing you to reach financial independence faster and with greater stability.

Part 5: Overcoming Common Roadblocks

Achieving financial independence in 7 years or less is not without challenges. Many people encounter personal, social, and psychological hurdles that can derail their progress. This section explores common roadblocks and provides actionable strategies to overcome them.

The Role of Relationships

The people you surround yourself with can either propel you forward or hold you back. For many, the biggest challenge comes from their closest relationships—especially a spouse or partner.

- Challenges with Spouses/Partners:

- Lack of Alignment: If your partner doesn’t share your vision or isn’t willing to sacrifice, progress can stall.

- Conflict Over Sacrifice: Disagreements about cutting expenses or delaying gratification can create tension.

- Strategies to Address Relationship Challenges:

- Communicate the Vision: Share your plan for financial independence and the long-term benefits it brings. Use real-life examples or models to explain the payoff.

- Compromise Where Possible: Find ways to balance your partner’s needs with your goals, such as allocating a small percentage of savings for shared enjoyment.

- Delay Serious Relationships: If you’re single, consider waiting to pursue long-term relationships until you’ve completed the initial sacrifice phase. Personal growth and financial stability will make you more attractive to like-minded individuals.

- Your Support System:

- Build a network of like-minded individuals who understand your goals.

- Join online communities or groups focused on financial independence for encouragement and shared strategies.

Dealing with Risk Aversion

Many people are hesitant to take risks, whether it’s leaving a stable job, starting a business, or investing in real estate. This fear often stems from generational wiring or a lack of confidence.

- Understanding Risk:

- Recognize that calculated risks are necessary for significant growth.

- Differentiate between reckless decisions and informed strategies.

- Strategies for Risk-Averse Individuals:

- Start Small: Invest small amounts in index funds or low-risk properties to build confidence.

- Educate Yourself: Knowledge reduces fear. Learn about the strategies you plan to implement.

- Tailor Your Approach: If entrepreneurship or heavy leveraging isn’t for you, focus on high-income jobs, consistent saving, and index fund investing.

Breaking Free from Traditional Mindsets

Many people are conditioned to follow a conventional life path: working 40 hours a week for 40 years, relying on a degree or career for stability, and avoiding anything outside the norm. To succeed, you must break free from these limiting beliefs.

- Challenge the “Fallback Mentality”:

- Instead of relying on a degree or job as a safety net, focus on building income streams that don’t depend on your time.

- Develop skills that make you adaptable in any economic environment.

- Overcoming Societal Expectations:

- Ignore societal pressure to maintain a certain lifestyle (e.g., buying a house, driving a new car, or taking lavish vacations).

- Remind yourself that these sacrifices are temporary and that financial freedom is worth the trade-off.

Managing Personal Burnout

The intensity of saving, working multiple jobs, or running a side hustle can lead to burnout if not managed properly. Here’s how to stay motivated:

- Keep the Vision Front and Center:

- Regularly revisit your goals and visualize the freedom you’ll gain once you achieve them.

- Track Your Progress:

- Track your progress to see how far you’ve come.

- Take Breaks When Needed:

- Allow yourself occasional rewards or downtime to recharge.

- Leverage Support Systems:

- Surround yourself with people who motivate and encourage you.

- Share your wins and challenges with others pursuing similar goals.

- Priority Your Health:

- Prioritize sleep, nutrition, and exercise.

- Make time for relaxation and hobbies to prevent burnout.

Learning to Handle Setbacks

Not every step of your journey will go as planned. Markets fluctuate, deals fall through, and unexpected expenses arise. What matters is how you respond:

- Expect the Unexpected:

- Build an emergency fund to cover unexpected costs.

- Diversify your income and investments to reduce risk.

- Adapt and Adjust:

- If a strategy isn’t working, pivot to a new approach.

- Stay flexible and open to new opportunities.

Why Overcoming These Challenges Matters

Financial independence isn’t just about numbers—it’s a mindset and a lifestyle. Learning to navigate these roadblocks will not only help you achieve your goals faster but also build resilience and discipline that will serve you for life. By overcoming these challenges, you’ll emerge stronger, more adaptable, and ready to enjoy the freedom you’ve worked so hard to achieve.

Part 6: The Snowball Effect

Once your financial journey gains momentum, something incredible happens: the snowball effect. This phenomenon occurs when your growing assets, income, and skills combine to create exponential growth. The more you achieve, the faster you can accelerate your progress toward financial independence. This section explores how to harness the power of the snowball effect and maintain your newfound freedom.

Understanding the Snowball Effect

The snowball effect is a natural outcome of consistent effort, smart investments, and disciplined saving. Here’s how it works:

- Compounding Returns:

- Money invested generates returns, which are reinvested to generate even more returns. Over time, this leads to exponential growth.

- Income Growth:

- As your skills and experience grow, so does your earning potential. Each pay raise or business success fuels further investments.

- Asset Multiplication:

- Real estate properties appreciate and generate cash flow, which can be reinvested to acquire more properties or other assets.

- Network Effect:

- As your network grows, so does your opportunities for growth and passive income.

Strategies to Maximize the Snowball Effect

To fully benefit from the snowball effect, you need to keep feeding it with new resources and managing it wisely. Here are key strategies:

- Reinvest Earnings:

- Keep reinvesting dividends, rental income, or business profits instead of spending them.

- Allocate these funds to high-growth investments like index funds, new properties, and/or businesses.

- Scale Income Streams:

- Transition from small, time-intensive side hustles to larger, scalable ventures.

- Build passive income streams that grow with minimal additional effort, such as digital products, royalties, loans, or larger property portfolios.

- Particpate in private offerings in Private Equity, Venture Capital, and Real Estate.

- Seek Professional Advice:

- Seek advice from several tax professionals to help you navigate the complexities of tax-advantaged strategies and minimize your tax liability such as establishing passive holdco entities, active income entities, complex irrevocable trusts structures, investing in tax favored assets, maximizing the right amount of personal withdrawl rates.

- Seek advice from various lawyers to help you with asset protection to ring fence your risk, establish trusts, potential immigration planning, estate planing, etc.

- Leverage Equity in Assets:

- Use the equity in your existing properties to acquire additional assets through refinancing or home equity lines of credit (HELOCs).

- Leverage the equity in your stock portfolio with SBLOCs (Securities-Based Lines of Credit), enabling you to borrow against your investments without selling them. This approach avoids triggering taxes while allowing your underlying assets to continue growing.

- Utilize your business’s balance sheet by securing loans or revolving lines of credit within the company to fund further investments or acquisitions, backed by the cash flow generated from operations.

- Expand your portfolio without draining your cash reserves.

If you owe the bank $1 million that’s your problem. If you owe the bank $100 million, that’s the bank’s problem. - J. Paul Getty